Recently a new connection of mine commented, "gossiping hurts three people: the one that listens, the one that talks, and the one that is spoken of . . . this is akin to a type of murder of the soul, according to the Torah." People who gossip possess an evil tongue (lashon hara). A conversation ensued about the nature of gossip.

This conversation reminded me of a lengthy discussion I had had about a similar subject when I was a catechumen in Providence, RI (a befitting place to convert to Catholicism and in a parish that truly welcomed all. Case in point: the first baptism I saw at my parish was that of an adopted baby whose parents were lesbians. I knew right there and then that I was in the right parish). This particular discussion was about water cooler gossip, and why it's disrespectful to:

a) God

b) yourself (if you are the gossiper)

c) the listener

d) the person against whom you're speaking

I've also been thinking a lot about maliciousness recently. Unfortunately, we find ourselves subjected to maliciousness all too frequently. It's most hurtful when it's a person you thought you knew or to whom you are still close . . . it's particularly bad when their gossip is turned against you. While I don't mean to simplify the rich complexity of humans and their relationships to one another, I think it's safe to say that there are two types of people in this world:

i) those who judge indiscriminately and are unforgiving

ii) those who judge and then use the gift of discernment to be more understanding

I don't mean to toot my own horn, but I know the category into which I fall. There are a lot of reasons why I fall into that category, but I'll save those details for my memoir.

I think we all judge, but when it's combined with the gift of discernment, it can be a valuable tool. Discernment makes you kinder towards others, and can also inform your politics in positive ways.

Education in all its forms interests me. This blog promotes discussion of critical issues that higher educational institutions are facing today.

Minggu, 27 Desember 2009

Minggu, 20 Desember 2009

Why is 23K the magic number?

Sandy Baum claims, "…While the sticker price for attending college continues to climb, the net cost — after taking into account grants and discounts — is actually lower now than five years ago." (I'm pulling this quote from a poster here from Jacques Steinberg's NYT piece).

What is she talking about? Can anyone explain this claim to me? I know Edububble is confused by the continued numbers that supposedly demonstrate an accurate reading of college debt.

Truth is, we've all been sold a bill of goods. Edububble also brings up how many of us are deliberately misled. He's following one of my favorite blogs - Temporary Attorney.com - and mentioned a number of comments there about employment promises. Apparently people think that schools lie about the success rates of their graduates. Gasp! How could that be? I mean, it's like thinking The College Board is filled with sycophants who want to hide the truth from future borrowers by spinning numbers just the right way. Welcome to the student debt trap.

What is she talking about? Can anyone explain this claim to me? I know Edububble is confused by the continued numbers that supposedly demonstrate an accurate reading of college debt.

Truth is, we've all been sold a bill of goods. Edububble also brings up how many of us are deliberately misled. He's following one of my favorite blogs - Temporary Attorney.com - and mentioned a number of comments there about employment promises. Apparently people think that schools lie about the success rates of their graduates. Gasp! How could that be? I mean, it's like thinking The College Board is filled with sycophants who want to hide the truth from future borrowers by spinning numbers just the right way. Welcome to the student debt trap.

Sabtu, 19 Desember 2009

Korea, here I come

Many of you know that I am leaving the country and soon. I was offered a great teaching job that I couldn't turn down. Like so many of you, I sent out thousands of resumes and even managed to land some job interviews. One company even flew me up to Boston - I was their no. 1 pick - but then it turned out the old man boss didn't really fancy me and decided to change the entire job description, so I was no longer a candidate. Oh, and did I mention that that was after the following projects:

(1) Two preliminary screenings with their recruiter who found my profile on LinkedIn (it works - sign up). It was the day after my dog died, so I thought, "what the hell? I'll give this opportunity a try."

(2) An hour-long phone interview with the VP (who is a lovely individual and someone with whom I wanted to work)

(3) A trip to Boston in one day (I was up for 16+ hours) to be interviewed by said p--- president, VP, and other members of the company. . .

Oh, but wait, those things weren't good enough. Remember? There are legions of highly qualified candidates, so they had me do another test. This time, I had to do a Webinar for the Prez and his crew. After that stage, the dude decided I wasn't the right choice. I really appreciated that. What a swell flippin' guy.

I also had an amazing job interview for a social media analyst position in the D.C. area. That would've been fabulous, and I am so glad I connected with the person recruiting for it. Swell job, swell position, swell crew of people (clear to me from meeting the main interviewer). But here's the kicker. I made it to the final cut(s) after 80 other people!

In addition, I left my job in publishing to pursue a full-time job for an advocacy group, but . . . uh . . . that kinda fell through too.

Regardless, I will continue to advocate and plan on writing a book about this dilemma. I may be overseas but the work for the cause continues (trust me, it does!).

(1) Two preliminary screenings with their recruiter who found my profile on LinkedIn (it works - sign up). It was the day after my dog died, so I thought, "what the hell? I'll give this opportunity a try."

(2) An hour-long phone interview with the VP (who is a lovely individual and someone with whom I wanted to work)

(3) A trip to Boston in one day (I was up for 16+ hours) to be interviewed by said p--- president, VP, and other members of the company. . .

Oh, but wait, those things weren't good enough. Remember? There are legions of highly qualified candidates, so they had me do another test. This time, I had to do a Webinar for the Prez and his crew. After that stage, the dude decided I wasn't the right choice. I really appreciated that. What a swell flippin' guy.

I also had an amazing job interview for a social media analyst position in the D.C. area. That would've been fabulous, and I am so glad I connected with the person recruiting for it. Swell job, swell position, swell crew of people (clear to me from meeting the main interviewer). But here's the kicker. I made it to the final cut(s) after 80 other people!

In addition, I left my job in publishing to pursue a full-time job for an advocacy group, but . . . uh . . . that kinda fell through too.

Regardless, I will continue to advocate and plan on writing a book about this dilemma. I may be overseas but the work for the cause continues (trust me, it does!).

Kamis, 17 Desember 2009

"Would you like to use a credit card to pay off your $86,000 student loan debt?"

That's no joke. A loan manager asked a woman that question. It was in reference to what good ol' First Premier Bank is doing. Over at the Huff Post they inform us they're charging 79.9% on a new credit card. Ain't that dandy? Luckily, there are people on the Hill and elsewhere who cares much about the poors peoples of this country. Thank heavens for that. If we didn't have so many people who cared about the downtrodden in this coutnry, the poorsies may be paying, like, 100% in interest or something. (Oh, wait . . . kinda like they do on their student loan debt. My bad. Tee-hee).

When I first read this headline, I had to do a double-take and then I asked myself, "maybe you clicked on The Onion instead?" Nope. It's for reelz.

And I had to confirm with a reader that the loan manager did indeed ask her if she would like to use a credit card to pay off her 86k. When the debtor said she didn't have the money, here's some other hysterical things the loan manager said:

-"[You're] refusing to ask [your] family for money." (Oh. My. God. That loan manager has a point. She should totally ask her fam for money. Like, gawd).

My personal favorite:

When I first read this headline, I had to do a double-take and then I asked myself, "maybe you clicked on The Onion instead?" Nope. It's for reelz.

And I had to confirm with a reader that the loan manager did indeed ask her if she would like to use a credit card to pay off her 86k. When the debtor said she didn't have the money, here's some other hysterical things the loan manager said:

-"[You're] refusing to ask [your] family for money." (Oh. My. God. That loan manager has a point. She should totally ask her fam for money. Like, gawd).

My personal favorite:

-"You should marry a rich man." (Like, duh . . . I think that's dang good advice).

Hey, honey - rich husbands offer more than just toasters!

You've got to be kidding me. The Washington Post is up to it again - Michelle Singletary is guilty

OK, so this little piece of advice from Michelle Singletary is hysterical. She writes blase advice columns and this one happens to have a kernel of uselessness on the topic of student loan debt. But I know exactly why she writes fluff - because the WP is kept afloat by Kaplan. So, the WP either talks about happy-go-luck grads who have no debt (see here) or they write about extraordinary cases like this one. I have to quote the snippet in its entirety:

Frustrated in D.C.: Dear Michelle, I do appreciate your advice. However, you say to pay off all your significant debt before making any major purchases, such as a house. That means I'll be 50 (right now I'm 30) before I pay off my student loans and can buy a house! There goes my motivation to pay off my debt! What to do? My budget is already trimmed and I'm not saving any money for the future.

Michelle Singletary: I know what I'm proposing is tough. And it's different.

But it can be done and before you turn 50. Just recently I had an award ceremony for the financial ministry I direct at my church. During the program, one participant, whose husband is an educator, testified that they had gotten rid of $60,000 in student loan debt in TWO YEARS. This was debt the husband thought he would take to his grave. They weren't earning boatloads of money.

How did they do it?

The wife took all her bonuses and helped apply it to the debt. They cut their expenses -- like skipping taking vacations. They participated in the 21-day financial fast I developed (in this you don't spend money on anything that is not a necessity). They stop using credit cards.

Two years and $60,000.

Many of us cried.

What I'm asking you do to is move into your home as debt-free as possible. Get rid of that student loan bondage and when you get that house it will be so wonderful.

I think it's wonderful that this wife and husband were able to get out of debt. That's great for them! But I'd like to know why Michelle Singletary hasn't written any pieces that take a look at the macro implications of the student lending crisis - what about the hundreds of thousands of people who are drowning in student loan debt? What about the ones who can't have children because of their degrees? What about parents or grandparents who co-signed on private loans? What about the cases in which students were misled by financial aid officers on campus and directed to take out the wrong loans? I'd like to know about the 7,000 nurses and teachers in Kentucky who were denied loan forgiveness - what's been done to help those families? These are all topics - among many more - I'd prefer reading about because these anecdotes about a couple that Ms. Singletary happens to know in her Church aren't newsworthy. In fact, it doesn't say a damned thing about the actual crisis. Also, I have news for Ms. Singletary, most people who are drowning in student loan debt aren't taking any vacations. They aren't even able to put food on the table.

Frustrated in D.C.: Dear Michelle, I do appreciate your advice. However, you say to pay off all your significant debt before making any major purchases, such as a house. That means I'll be 50 (right now I'm 30) before I pay off my student loans and can buy a house! There goes my motivation to pay off my debt! What to do? My budget is already trimmed and I'm not saving any money for the future.

Michelle Singletary: I know what I'm proposing is tough. And it's different.

But it can be done and before you turn 50. Just recently I had an award ceremony for the financial ministry I direct at my church. During the program, one participant, whose husband is an educator, testified that they had gotten rid of $60,000 in student loan debt in TWO YEARS. This was debt the husband thought he would take to his grave. They weren't earning boatloads of money.

How did they do it?

The wife took all her bonuses and helped apply it to the debt. They cut their expenses -- like skipping taking vacations. They participated in the 21-day financial fast I developed (in this you don't spend money on anything that is not a necessity). They stop using credit cards.

Two years and $60,000.

Many of us cried.

What I'm asking you do to is move into your home as debt-free as possible. Get rid of that student loan bondage and when you get that house it will be so wonderful.

I think it's wonderful that this wife and husband were able to get out of debt. That's great for them! But I'd like to know why Michelle Singletary hasn't written any pieces that take a look at the macro implications of the student lending crisis - what about the hundreds of thousands of people who are drowning in student loan debt? What about the ones who can't have children because of their degrees? What about parents or grandparents who co-signed on private loans? What about the cases in which students were misled by financial aid officers on campus and directed to take out the wrong loans? I'd like to know about the 7,000 nurses and teachers in Kentucky who were denied loan forgiveness - what's been done to help those families? These are all topics - among many more - I'd prefer reading about because these anecdotes about a couple that Ms. Singletary happens to know in her Church aren't newsworthy. In fact, it doesn't say a damned thing about the actual crisis. Also, I have news for Ms. Singletary, most people who are drowning in student loan debt aren't taking any vacations. They aren't even able to put food on the table.

Rabu, 16 Desember 2009

Please join "Stop Quoting the College Board" - send a clear message to journalists that their stats are inaccurate and sheer spin

Thanks to a good email conversation with the creator of No Sucker Left Behind, we've decided that it's high time that journalists stopped quoting the College Board. (See my latest post for details). The best way to make a stand against the College Board? Join our Facebook page, "Stop Quoting the College Board."

Quick post: Revisiting the reasons why the College Board is not a reliable source

If you read an article that refers to the College Board and their numbers, don't buy it. It's a bunch of hooey.

Thanks to No Sucker Left Behind, I was inspired to write this post.

Let's dig up some oldies but goodies about the College Board. Back in the summer when I was still affiliated with a forgive student loan debt movement, I got into it with individuals there - Patricia Steele and Sandra Baum. I encourage you to read these pieces and share 'em with others.

- Breaking News Part I: My Debate with Patricia Steele and Sandy Baum

- Breaking News Part II: The College Board USED to be a LENDER

- And yet another posting about the College Board

This part of the machine is bent on providing misinformation that reporters readily swallow and spit back up - it provides for tepid readings on an enormous lending crisis that's already burst.

Thanks to No Sucker Left Behind, I was inspired to write this post.

Let's dig up some oldies but goodies about the College Board. Back in the summer when I was still affiliated with a forgive student loan debt movement, I got into it with individuals there - Patricia Steele and Sandra Baum. I encourage you to read these pieces and share 'em with others.

- Breaking News Part I: My Debate with Patricia Steele and Sandy Baum

- Breaking News Part II: The College Board USED to be a LENDER

- And yet another posting about the College Board

This part of the machine is bent on providing misinformation that reporters readily swallow and spit back up - it provides for tepid readings on an enormous lending crisis that's already burst.

Citigroup's big tax break, Wall St. continues to hum along like it always has, and we're all drowning in more debt. Oh, and guess what? Defaults are up!

Matt Taibbi, who himself was in exile over in Russia during the 1990s, wrote a damning article in Rolling Stone. It's a nasty analysis of the fact that Obama is a big sell out (that's the title of the article) and details the economic policies and individuals Obama appointed to his economic advisory team - these people have little if any concern for the rest of us (Larry Summers is just one of many, and I am not a fan of his). As Taibbi sees it, this economic team is "made up exclusively of callous millionaire-assholes [who have] absolutely zero interest in reforming the gamed system [i.e., Wall Street] that made them rich in the first place."

Today I read that Citigroup (mentioned left and right in the above article) has received a generous tax break from IRS. Hooray! Hooray. My enthusiasm is waning, but perhaps that's because I'm ill. Instead of being employed as an analyst or working for the people as a bureaucrat in perhaps the Department of Education, I'm being forced to move, move, move for the holiday season. The past few days I've worked at least 8-10 hours and have been so busy I've been out of breath. But ain't that great? That's why I went to school to become a thinker and analyze documents - indeed, I'm so glad I went to U. of Chicago, Brown, and Harvard. It's really paying off. Now I'm sick as a dog and really don't have the energy to bark about these folks on the Hill and in the White House, because I'm too exhausted to do so. Luckily, I have options and am leaving this country to teach. That's after all what part of my training was to do - to teach, to educate. That's called community service if you ask me. Too bad I can't do such things in my own damned country. Even though I'm workin' like a dog, I ain't makin' a dime. Why? Because consumers have steel clamps on their wallets. Trust me, things are bad. I know that because I'm on a sales floor, and so an article like this one further proves my fears and analysis about this floundering economy.

And we're all too tired to be doing anything, especially those of us who are unemployed or underemployed (as Barbara Ehrenreich recently discussed here). Indeed, we're too busy working on re-branding (white collar folks) or re-training (stuffing those community colleges to the gills - that's only good news for the student loan sharks).

Meanwhile, defaults on student loans have gone up a startling rates. All these things just aren't adding up. I thought this Administration was into populist politics and looking out for those of us drowning in debt. But I guess all these things are our own fault, because we failed to consider the degrees were seeking. (That's what all the critics are saying about us, and I'm sure glad the Administration is there to stand up for our rights and set the record straight about the student loan debt trap). Hmph.

Today I read that Citigroup (mentioned left and right in the above article) has received a generous tax break from IRS. Hooray! Hooray. My enthusiasm is waning, but perhaps that's because I'm ill. Instead of being employed as an analyst or working for the people as a bureaucrat in perhaps the Department of Education, I'm being forced to move, move, move for the holiday season. The past few days I've worked at least 8-10 hours and have been so busy I've been out of breath. But ain't that great? That's why I went to school to become a thinker and analyze documents - indeed, I'm so glad I went to U. of Chicago, Brown, and Harvard. It's really paying off. Now I'm sick as a dog and really don't have the energy to bark about these folks on the Hill and in the White House, because I'm too exhausted to do so. Luckily, I have options and am leaving this country to teach. That's after all what part of my training was to do - to teach, to educate. That's called community service if you ask me. Too bad I can't do such things in my own damned country. Even though I'm workin' like a dog, I ain't makin' a dime. Why? Because consumers have steel clamps on their wallets. Trust me, things are bad. I know that because I'm on a sales floor, and so an article like this one further proves my fears and analysis about this floundering economy.

And we're all too tired to be doing anything, especially those of us who are unemployed or underemployed (as Barbara Ehrenreich recently discussed here). Indeed, we're too busy working on re-branding (white collar folks) or re-training (stuffing those community colleges to the gills - that's only good news for the student loan sharks).

Meanwhile, defaults on student loans have gone up a startling rates. All these things just aren't adding up. I thought this Administration was into populist politics and looking out for those of us drowning in debt. But I guess all these things are our own fault, because we failed to consider the degrees were seeking. (That's what all the critics are saying about us, and I'm sure glad the Administration is there to stand up for our rights and set the record straight about the student loan debt trap). Hmph.

Madonna of the Poor sure ain't watching over Citigroup

Jumat, 11 Desember 2009

Sarah shares - drowning in student loan debt and at risk of losing her home with her folks

Ms. Sarah Shelnutt

Correspondence with this young woman was inspiring. She never once moaned about her circumstances (although she is justified in doing so), and I was awestruck by her cheerful attitude. While reading her heart-wrenching narrative that resulted in several tearful moments, I suddenly stopped crying when she signed off in this way: "I suppose we're an interesting/unusual case with the crumbling economy. I'm going to make an attempt to catalog at least some of it. . . .Thanks for listening. :) "

Wow. I never realized the power of a smiley face icon until this moment.

Its simplicity also made me feel a bit foolish for being so weepy. I shouldn't have to cry over her circumstances, because there should be policy makers making note of these tales and doing something about it now - I know if I were a policy maker or had any direct lines into the White House or ties to the Department of Education, I wouldn't be crying, but rather insisting that we shift that stimulus money in this direction, i.e., towards people who are drowning in student loan debt. (I mean, right now the Obama Adminstration is determining what to do with $3 billion. Why couldn't some of that money be used to help out student borrowers? Why is there any reason to say no? Keep in mind, those who helped Obama win the election - age group of 18-30 somethings - are now those who are facing crushing student loan debt along with unemployment or severe underemployment).

Sarah and her family would definitely benefit from some help.

Moreover, United Professionals was interested in Sarah's story, too. (I passed it along to a close partner there). We agreed that it would be great if Sarah were willing to be featured. Her story entitled, "Desperate to Pay Bills and Buy Food," is provocative because it highlights several crises that are occurring in this country. Sarah and her parents are suffering the following systemic problems that millions of other Americans are facing:

(a) The student lending crisis - at this point, there is no alternative policy in place that could help people like Sarah immediately

(b) The health care crisis

(c) Joblessness and underemployment

(d) Fears of impending foreclosure

Sarah Shelnutt poignantly discusses her struggles and current circumstances - policy makers ought to be aware that her story is not unusual. United Professionals said about her story (that is, unfortunately, all too common in the U.S.), "this kind of thing should not be happening in the U.S., the richest country in the world." Indeed.

Sarah and millions of people like her are why I'm frantically working on things behind the scenes (that's between the times I'm selling cashmere sweaters). I am also glad that many talented and smart volunteers in Nebraska, Louisiana, Pennsylvania, Arkansas, Minnesota, Kentucky, and so forth are making inroads on the local and state levels.

This battle is far from over, but our window of opportunity will not remain open forever.

Despite Sarah's crumbling financial situation and overwhelming responsibilities, she remains cheerful and hard-working. Let's hope she can be a successful cake maker some day.

Kamis, 10 Desember 2009

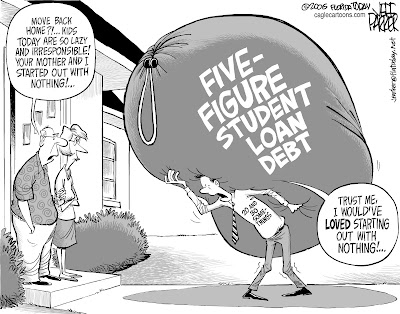

Here's why retailers and other industries ought to be mad as hell - the student lending industry has cornered their markets

Does this funny political cartoon remind you of your own not-so-funny world, one in which you can't buy things from retailers? Several months ago, I asked people to tell me what they'd spend they're money on if they didn't have to send half their paychecks (or more) to pay for student loan debts that will never go away. Here are a few things people shared:

-"If I didn't have to pay my student loan debt, I would spend money I don't have now visiting my elderly parents more often. So I'd be spending the money with Southwest Airlines. Not even having a job I don't know when I can see them again and they're in their 80s. People don't last forever and you never know when 'never' will come."

- "I'd spend at least $75.00 a month at Race Trac gas station so I could visit out of town friends. These are items I don't get to purchase on account of owing so much to my lenders."

- "I would shop at Target more often, for curtains and items I am really in need of but simply can no longer afford. Since the loan will take forever to repay, I will be curtailing spending for the [next] 20 years."

- [It would nice to buy] action figures and baby dolls at Toys R Us."

Rabu, 09 Desember 2009

Family, having children - who's picking up on this situation vis-a-vis the student lending crisis

My last post was called "The Saddest Comment of the Day." It was about the fact that many people are realizing they can't have children as a result of their student lending crisis - many of you have told me that you're anguishing over this fact. I've written about this situation for months and have been frank, admitting that I'm in the same camp. (This last post was written as a result of a piece that was put out by the Catholic News Agency).

In any event, there's been several pieces by key education bloggers - you can find discussions about the indentured educated class being unable to have children here:

Edububble (thanks again for the mention) - "Family Life and Education"

The always-quantitatively impressive SLA - "New Student Loan Debt Forgiveness Idea: Have Kids"

I am also asking people to share their comments about children - I'm trying to collect as many statements as possible. Once I've gotten at least 20 or so, I'll post them here with my own "confession."

In any event, there's been several pieces by key education bloggers - you can find discussions about the indentured educated class being unable to have children here:

Edububble (thanks again for the mention) - "Family Life and Education"

The always-quantitatively impressive SLA - "New Student Loan Debt Forgiveness Idea: Have Kids"

I am also asking people to share their comments about children - I'm trying to collect as many statements as possible. Once I've gotten at least 20 or so, I'll post them here with my own "confession."

If you'd like to be quoted about being unable to have children as a result of your student loan debt, please send Education Matters an email (ccrynjohannsen@gmail.com). We'll post your comment anonymously (the first initial of your first name and the state in which you reside will be the only things listed).

Senin, 07 Desember 2009

Saddest Comment of the Day

In response to an article I posted, which was entitled, "Student Loan Debt 'Crushing Burden' That Harms Young Families," a young woman - Ms. G. - replied: "the grief of not having a family due to student loan debt is probably going to crush me."

I read that comment on my Blackberry on my way home from my retail job (a co-worker was ill, so I had to cover for her shift on my day off - days that are precious, because they allow me to do as much reading, writing, and advocacy work as humanly possible). In any event, Ms. G.'s remark saddens me, and it also made me think about the meaninglessness of certain customers who get irate when their size or color is not in our store.

I read that comment on my Blackberry on my way home from my retail job (a co-worker was ill, so I had to cover for her shift on my day off - days that are precious, because they allow me to do as much reading, writing, and advocacy work as humanly possible). In any event, Ms. G.'s remark saddens me, and it also made me think about the meaninglessness of certain customers who get irate when their size or color is not in our store.

Let's hope Ms. G. is able to hold little baby feet in her hands some day.

Outsourcing Legal Work

I guess for some companies the economic crisis will be a good thing for them in the end. Wow. Shocking. Many companies will come out stronger, while the middle and lower classes experience more debt, more foreclosures, and more emotional pain. Next up: more economic suffering is to be expected for U.S. attorneys and anyone working in the legal industry. It seems it's inevitable that outsourcing legal work will increase during and after the recovery. A report entitled, Legal Service Outsourcing: Crisis Creates New Opportunities for LPOs, details the success of outsourcing legal work to India.

Once these jobs are moved offshore, the chances of them returning are slim to none. As on legal specialist stated, "Once you've moved work offshore . . . there's no imperative to bring it back onshore. The work is only going in one direction, and law firms are increasing the scope and scale of the outsourcing arrangements they are entering into. We are seeing a big shift from a situation where some law firms were piloting projects to one where many more are piloting, but an even larger number are looking at structural transformation."

What does this mean for people who are in law school right now, and for those who are unemployed or underemployed attorneys in this country? Also, what about the number of individuals who hold other positions within the legal industry (legal secretaries, paralegals, etc.)?

It overwhelms me to think about this move to send legal services overseas vis-a-vis the student lending crisis. And I'm not sure why these types of things should be accepted as inevitable.

Once these jobs are moved offshore, the chances of them returning are slim to none. As on legal specialist stated, "Once you've moved work offshore . . . there's no imperative to bring it back onshore. The work is only going in one direction, and law firms are increasing the scope and scale of the outsourcing arrangements they are entering into. We are seeing a big shift from a situation where some law firms were piloting projects to one where many more are piloting, but an even larger number are looking at structural transformation."

What does this mean for people who are in law school right now, and for those who are unemployed or underemployed attorneys in this country? Also, what about the number of individuals who hold other positions within the legal industry (legal secretaries, paralegals, etc.)?

It overwhelms me to think about this move to send legal services overseas vis-a-vis the student lending crisis. And I'm not sure why these types of things should be accepted as inevitable.

Minggu, 06 Desember 2009

Dean of Most Overpriced Law School in US is now head of the Board of Directors for Private Student Loan Financing Company -

Over at Temporary Attorney, they're reporting on some problematic connections - a dean of the most overpriced law school in the U.S. ("who has," Temporary Attorney explains, "jacked up tuition 5x faster than inflation over the last 10 years") is now HEAD OF THE BOARD OF DIRECTORS for a PRIVATE LOAN FINANCING COMPANY. What on earth is happening in this country? Hmmmm . . . can you say conflict of interest? Not only that, we have a bunch of senators who've been bought out by Sallie Mae and Nelnet. But dear readers we're getting organized and through collective action we're going to make a difference. Stay tuned - I have recruited smart, energetic volunteers in Nebraska, Kentucky (big problems there - 7000 teachers were screwed and lied to - they were promised student loan debt forgiveness. But whoopsy, it didn't happen), Minnesota etc. Meanwhile, there are some lazy, uniformed peeps "attacking" our efforts. The level of contradictions in this person's post makes me wonder if using that term is even warranted - it seems they may have had too much to drink when writing this convoluted piece.

On top of these able volunteers organizing at a local and state level, we have some bright and creative filmmakers out in L.A. collecting devastating stories and powerful footage highlighting the student lending industry. When I leave the country I will be meeting them (I'm departing from L.A., and my work and activism will certainly not end).

Speaking of drinks and drunkeness, let's pop some champagne and celebrate the wicked, unregulated, and utterly corrupt student lending industry! Pop! Hooray! We're all part of the indentured educated class thanks to universities, ridiculous self-serving Deans (like the one mentioned above), bloated administrative campus offices, Sallie Mae, Nelnet, etc. Drink up, my loves! We're not going to be like this much longer - not if I have anything to say about it. It's time to break these shackles.

On top of these able volunteers organizing at a local and state level, we have some bright and creative filmmakers out in L.A. collecting devastating stories and powerful footage highlighting the student lending industry. When I leave the country I will be meeting them (I'm departing from L.A., and my work and activism will certainly not end).

Speaking of drinks and drunkeness, let's pop some champagne and celebrate the wicked, unregulated, and utterly corrupt student lending industry! Pop! Hooray! We're all part of the indentured educated class thanks to universities, ridiculous self-serving Deans (like the one mentioned above), bloated administrative campus offices, Sallie Mae, Nelnet, etc. Drink up, my loves! We're not going to be like this much longer - not if I have anything to say about it. It's time to break these shackles.

Circle of hell where those who created the indentured educated class - Dante was most disturbed when Virgil described their sins.

Jumat, 04 Desember 2009

What's going on at the Washington Post? Why aren't they writing REAL stories about the student lending industry?

I've been surprised by the lack of stories about the student lending crisis in the Washington Post. The most recent one was downright appalling, and I'm being reserved in describing it as such. Last Sunday they wrote about a young woman who went to GWU. She has been unable to find a job, and she comes from a highly successful and competitive family. Even though it's too bad her brother judges her for being out of work, the story implies two problematic things:

1) most young people, like Ms. Meyer, may not be employed and living at home, but that's really not a big deal. After all, she gets to go to yoga and takes regular hikes with her boyfriend

2) her parents paid for her schooling, which is rare.

Why doesn't the Post actually publish more accurate pieces about people who don't have the luxury of returning home? What about the ones who are drowning in debt? (A 1/3 of college students take out student loans to finance their education. Moreover, Tim Ranzetta over at Student Lending Analytics recently stated that 2/3 of graduating seniors in 2008 . . . incurred debt." Ranzetta is a painstaking number cruncher and always provides invaluable statistical analysis about the student lending industry.

I've also noticed that the University of Phoenix is always advertised in the Post. I imagine that's what is keeping that newspaper afloat, along with Kaplan. Hmmm . . . so is that maybe the reason for the poor coverage of the student lending crisis? (Just to be clear - Kaplan and WP are the same company; Kaplan profits are keeping WP afloat. Also, here's a disturbing tidbit on they way Kaplan hires entry-level admissions advisors).

All them folks on the Hill who make decisions about our lives read the Post. As their sipping their morning coffee in their D.C. offices, they can enjoy fluff pieces like the one about Ms. Meyer. They can think to themselves, "well, the recession isn't hurting this young graduate, so things can't be all that bad . . ."

Next up: who's gettin' their pockets lined by Sallie Mae and Nelnet - it's time to get organized at the local/state level and call out those politicians who've been bought by the worst of the worst in the student lending industry. I hope these politicians get nervous (some of 'em are up for some heated elections). Stay tuned! I already have volunteers helping me in numerous states across the country.

1) most young people, like Ms. Meyer, may not be employed and living at home, but that's really not a big deal. After all, she gets to go to yoga and takes regular hikes with her boyfriend

2) her parents paid for her schooling, which is rare.

Why doesn't the Post actually publish more accurate pieces about people who don't have the luxury of returning home? What about the ones who are drowning in debt? (A 1/3 of college students take out student loans to finance their education. Moreover, Tim Ranzetta over at Student Lending Analytics recently stated that 2/3 of graduating seniors in 2008 . . . incurred debt." Ranzetta is a painstaking number cruncher and always provides invaluable statistical analysis about the student lending industry.

I've also noticed that the University of Phoenix is always advertised in the Post. I imagine that's what is keeping that newspaper afloat, along with Kaplan. Hmmm . . . so is that maybe the reason for the poor coverage of the student lending crisis? (Just to be clear - Kaplan and WP are the same company; Kaplan profits are keeping WP afloat. Also, here's a disturbing tidbit on they way Kaplan hires entry-level admissions advisors).

All them folks on the Hill who make decisions about our lives read the Post. As their sipping their morning coffee in their D.C. offices, they can enjoy fluff pieces like the one about Ms. Meyer. They can think to themselves, "well, the recession isn't hurting this young graduate, so things can't be all that bad . . ."

Next up: who's gettin' their pockets lined by Sallie Mae and Nelnet - it's time to get organized at the local/state level and call out those politicians who've been bought by the worst of the worst in the student lending industry. I hope these politicians get nervous (some of 'em are up for some heated elections). Stay tuned! I already have volunteers helping me in numerous states across the country.

Why won't they write about me? I represent FAR more people in this country than Ms. Meyer. Do those politicians we're gonna call out soon give a crap about the fact that they're dumping anvils of financial doom on our heads after we graduate from college?

Rabu, 02 Desember 2009

COLLEGE IS A RACKET

Edububble does it again. The latest post is based upon yet another "race-tinged" article and the despicable nature of college debt. This one comes from the Albany Times-Union and is by Scott Waldman. A former dean is suing and claiming that his school made a point to keep black students enrolled a tad longer for their bucks. Name of the school? That State University of New York at Cobleskill. (The school made no comment about the suit by Thomas Hickey - he's the former dean).

But here's what Edububble did best - s/he wrote, "So what do we do? [to "solve" all this b--s--t?] . . . The only solution is informing the public that college is as much of a racket as the car business, the plumbing business, and the roofing business [my emphasis]."

That's right, folks. College IS A RACKET.

But here's what Edububble did best - s/he wrote, "So what do we do? [to "solve" all this b--s--t?] . . . The only solution is informing the public that college is as much of a racket as the car business, the plumbing business, and the roofing business [my emphasis]."

That's right, folks. College IS A RACKET.

Selasa, 01 Desember 2009

The person who sells cashmere and can also discuss Dasein - Yelena features me on her awesome blog, Ivy Leagued and Unemployed

Many thanks to Yelena, over at Ivy Leagued and Unemployed, for featuring me on her blog. It's true. I can sell so much cashmere in an hour, I bet you would faint. I actually work so hard and move so fast - to avoid having sales stolen from me - that I have been pretty faint at work lately. Nice thing about springing in a department store? I've dropped at least one dress size since Black Friday (kid you not). Does that mean the recession is over, now that I'm sprinting to the back room to wrap up presents? Probably not. D.C. is a bubble, and many of the customers I help are from other parts of the country and live here for political reasons and so forth (they are diplomats, work for the World Bank, etc.).

I've heard some amazing stories lately, thanks to working in this area. One woman recently told me that she was slammed by shrapnel by a car bomb in Mosul. (She's a translator for the U.S. Army, and returning to that "very, very dangerous city.") The shrapnel landed in her uterus and she was flown to Germany for surgery. Another woman told us about the gold necklaces she was wearing. They were the most amazing gold pieces I'd ever seen on a person. I've seen pieces like that in museums, but never on a person. In any event, as she's telling a co-worker and me about her necklaces, where she got them (Iraq, Jordan, Saudi Arabia, etc.), she pointed out one particular ring. She said, "my Iraqi friend gave this ring to me. He was blown up in Baghdad by a car bomb." She quickly apologized, but I said, "there's no need to do that. It's your life. It's your story." I have to be honest, I've had to excuse myself after hearing these stories and cry a bit in the back.

Working on a sales floor and hearing those sorts of stories makes me realize that selling cashmere has opened me further to a complex world that's filled with both pain and joy (these tales and cultural interconnections are no longer tightly included in texts and discussed in cozy rooms in Providence or Cambridge). I'm also grateful to be working with lovely, hard-working women. They too are from all over the world. (One of them, a deeply religious Muslim woman, had to flee Afghanistan years ago - I have yet to hear her whole story, but she is kind and motherly. She likes to share her Kabob and rice with me in the back room. Her sense of humor is the best, and we hit it off immediately).

I am in debt and frustrated, but I am glad I work in retail - it reminds me of both the good and bad of humanity. But that's what makes live worth living. So . . . perhaps my education does matter.

I've heard some amazing stories lately, thanks to working in this area. One woman recently told me that she was slammed by shrapnel by a car bomb in Mosul. (She's a translator for the U.S. Army, and returning to that "very, very dangerous city.") The shrapnel landed in her uterus and she was flown to Germany for surgery. Another woman told us about the gold necklaces she was wearing. They were the most amazing gold pieces I'd ever seen on a person. I've seen pieces like that in museums, but never on a person. In any event, as she's telling a co-worker and me about her necklaces, where she got them (Iraq, Jordan, Saudi Arabia, etc.), she pointed out one particular ring. She said, "my Iraqi friend gave this ring to me. He was blown up in Baghdad by a car bomb." She quickly apologized, but I said, "there's no need to do that. It's your life. It's your story." I have to be honest, I've had to excuse myself after hearing these stories and cry a bit in the back.

Working on a sales floor and hearing those sorts of stories makes me realize that selling cashmere has opened me further to a complex world that's filled with both pain and joy (these tales and cultural interconnections are no longer tightly included in texts and discussed in cozy rooms in Providence or Cambridge). I'm also grateful to be working with lovely, hard-working women. They too are from all over the world. (One of them, a deeply religious Muslim woman, had to flee Afghanistan years ago - I have yet to hear her whole story, but she is kind and motherly. She likes to share her Kabob and rice with me in the back room. Her sense of humor is the best, and we hit it off immediately).

I am in debt and frustrated, but I am glad I work in retail - it reminds me of both the good and bad of humanity. But that's what makes live worth living. So . . . perhaps my education does matter.

Your salesgirl can find you the perfect French linen shirt, and afterward she can tell you sexy stories about DaSein. Please ask for leather gloves too. If you do, she'll also share more theories about the complex development of German philosophical thought after Nietzsche at the same time!

Yes, it's high time student loan borrowers were helped

November 28th has passed - the newbies are now facing student loan payment hell. I have already heard from a few new people who have joined our ranks. They're not happy, and they're having a helluva time paying their student loans and making ends meet. Honestly, I'm not sure how most people are doing it. I think it's safe to assume that most people are beginning to realize that they may soon fall off the grid and slip into that horrific realm that Mark Kantrowitz recently discussed. I call it Defaulter's hell. It's a devastating place filled with different types of devilish traps. Once there, people quickly lose all hope. They are ravaged and what they had been before - hopeful, energetic, adventurous - has died. Now they are wounded, howling beasts. Pathetic, isn't it? It's all thanks to an unregulated industry that continues to turn humans into angry, hopeless creatures.

Instead of discussing yet another relief program for mortgage holders, Tom Ranzetta over at SLA asked a question that I'd like answered: "So, what hope is there for struggling student loan borrowers?"

And don't tell me about IBR again. It's giving me an upset stomach, not to mention that it bores me. We need more. A LOT MORE.

I think it's pretty obvious why no one wants to talk about the student lending crisis. It's related to the banks and bailing out Wall Street. It's related to the most heinous aspects of our broken, so-called free market system (Yeah, if it were so "free," you WOULD HAVE LET THE BANKS FAIL.).

How many more of us will be reduced to living out lives so destitute and miserable that we'd actually begin to envy all those cars filled with cattle going off to slaughter?

Instead of discussing yet another relief program for mortgage holders, Tom Ranzetta over at SLA asked a question that I'd like answered: "So, what hope is there for struggling student loan borrowers?"

And don't tell me about IBR again. It's giving me an upset stomach, not to mention that it bores me. We need more. A LOT MORE.

I think it's pretty obvious why no one wants to talk about the student lending crisis. It's related to the banks and bailing out Wall Street. It's related to the most heinous aspects of our broken, so-called free market system (Yeah, if it were so "free," you WOULD HAVE LET THE BANKS FAIL.).

How many more of us will be reduced to living out lives so destitute and miserable that we'd actually begin to envy all those cars filled with cattle going off to slaughter?

I know Bosch's work well, and he at least helps me imagine Defaulter's Hell. Shucks. Studying all that European history sure paid off - I now know what student lending hell looks like.

Minggu, 29 November 2009

Quick post - Despicable: For Profit School Sucking Money from U.S. Govt - $1 BILLION!

Absolutely disgusting. The taste in my mouth is so bitter, I can't even stand to write about this article.

Reduce The Rate - Rev. Jesse Jackson

Please sign up at www.reducetherate.org, and stay tuned for more details. I obviously believe in a far more radical approach to solving the student lending crisis, but this proposal is at least a step in the right direction. I want to thank the Rev. Jesse Jackson and the Rainbow Push Coalition for acknowledging this major societal problem.

Sabtu, 28 November 2009

Twittering about Student Loan Debt and Primary Care Physicians with MedicineSux

After posting an article about a handful of Democrats who are trying to add loan forgiveness for doctors to the health care legislation on Facebook, a great conversation via snippets on Twitter with the wonderful blogger over at Medicinesux, quickly ensued. (There were also many insightful remarks made on my Facebook page, and I want to thank everyone for that lively conversation as well).

My energy remains focused on the overall student loan debt crisis. Of course, I do like to highlight the far-ranging cultural and intellectual ramifications of the problem I believe the crisis is causing and will cause. But I try to strike a steady balance between its macro (i.e., the broad range of societal problems it's causing) and micro implications (the human experiences of being rendered destitute by an unregulated student lending industry). It's nice to find people who can discuss the finer points of how the student lending industry is damaging their own areas of expertise - Medicinesux tells us a story of the hardships that many young doctors are now facing.

I don't dare speak about the health care debates. It's really too infuriating and for too many reasons - where does one even begin? Of course I think it's important to highlight how that crisis intersects regularly with the student lending crisis. I receive hundreds of emails each week, and so many of the stories I read also contain details about health problems and huge bills for medical treatment. I think it's safe to say that these emails probably reflect the struggles of millions of Americans who have to make the difficult choice to either pay for medical treatment or send money to the legalized student loan sharks.

I urged Medicinesux to write a blog post about our conversation last night. He made such good critiques that I wanted to read a fleshed account of those pithy remarks. I was delighted to find on my TweetDeck this morning a note from Medicinesux. He wrote: "wish granted," and provided me with this link.

In the next few weeks I am calling for submissions from readers. If you are interested in sharing your own analysis about the way in which the student lending crisis is affecting your industry, please write me an email (ccrynjohannsen@gmail.com). I look forward to reading and posting your accounts.

My energy remains focused on the overall student loan debt crisis. Of course, I do like to highlight the far-ranging cultural and intellectual ramifications of the problem I believe the crisis is causing and will cause. But I try to strike a steady balance between its macro (i.e., the broad range of societal problems it's causing) and micro implications (the human experiences of being rendered destitute by an unregulated student lending industry). It's nice to find people who can discuss the finer points of how the student lending industry is damaging their own areas of expertise - Medicinesux tells us a story of the hardships that many young doctors are now facing.

I don't dare speak about the health care debates. It's really too infuriating and for too many reasons - where does one even begin? Of course I think it's important to highlight how that crisis intersects regularly with the student lending crisis. I receive hundreds of emails each week, and so many of the stories I read also contain details about health problems and huge bills for medical treatment. I think it's safe to say that these emails probably reflect the struggles of millions of Americans who have to make the difficult choice to either pay for medical treatment or send money to the legalized student loan sharks.

I urged Medicinesux to write a blog post about our conversation last night. He made such good critiques that I wanted to read a fleshed account of those pithy remarks. I was delighted to find on my TweetDeck this morning a note from Medicinesux. He wrote: "wish granted," and provided me with this link.

In the next few weeks I am calling for submissions from readers. If you are interested in sharing your own analysis about the way in which the student lending crisis is affecting your industry, please write me an email (ccrynjohannsen@gmail.com). I look forward to reading and posting your accounts.

Student Lenders Selling the Souls of Those Seeking Education to the Devil - could one find a new twist on the Faustian pact with the Devil?

Rabu, 25 November 2009

When you realize the significance of Twitter- Lynnette Khalfani-Cox responds

With the continued support from readers, I have been able to throw myself into work that's meaningful and just plain good. I want to thank all of you for allowing me to be of service. I am humbly honored to be able to advocate for those who are struggling to pay off their debt and ensure that the student lending crisis is not marginalized.

Your stories have inspired me to reach out to as many people as humanly possible, and urge them to think about this major societal crisis. Today I feel as if this work is beginning to pay off.

A few moments ago I was delighted to have received a few Tweets from Lynnette Khalfani-Cox . I sent her a quick tweet last night about the student lending crisis, and here's what she said in response:

-"The student loan crisis is very important to me. I had $40K in college debt. Have written about this problem for years."

-"Under the Obama administration, I think there will ultimately be a push for more student loan forgiveness too."

Khalfani-Cox has a high media profile. She has appeared on Oprah and is frequently interviewed on CNN, MSNBC, etc. about issues relating to debt. It's a good thing that she responded, and I want to publicly thank her for her remarks.

On another front, I am working with a loose coalition of people, some of whom are connected to the Rev. Jesse Jackson, about the student lending crisis. (The group I've mentioned several times, TICAS.org, is also a part of this group. That's a very important group. TICAS was founded by Robert Shireman who is now the Deputy Undersecretary of Education. So, yeah, they're a critical connection to the White House). More details about this collaborative work will follow, but for the time being I wanted to provide you with a quick update of activities and correspondence. (I still need to post about my email correspondence with Dr. Noam Chomksy, too).

Also, many of you are encountering some serious problems with CITI. As many borrowers are aware, CITI took over AES. I am in the process of responding to several people who have asked me for advice with this situation and some other lenders. I have specific instructions and will send that out to the people who requested help shortly. NOTE: If you feel that your lender may be up to illegal activities, I urge you to get in touch with me ASAP. There are ways we can combat these problems, and I can provide you with assistance. (Please email me here - ccrynjohannsen@gmail.com).

All right, that's enough for now. Phew. I am excited! This Thanksgiving will be much better than I thought. And, yes, I will be working tomorrow. The student lending crisis continues at a rapid pace, so there is no resting at this point.

On a final note, I got a great job, and it will allow me to devote more time to my advocacy work and writing. That means I'll have more time to be of assistance to more people who feel trapped by the student lending crisis.

I hope all of you have a wonderful Thanksgiving.

Hooray! Perhaps we're being heard!

Your stories have inspired me to reach out to as many people as humanly possible, and urge them to think about this major societal crisis. Today I feel as if this work is beginning to pay off.

A few moments ago I was delighted to have received a few Tweets from Lynnette Khalfani-Cox . I sent her a quick tweet last night about the student lending crisis, and here's what she said in response:

-"The student loan crisis is very important to me. I had $40K in college debt. Have written about this problem for years."

-"Under the Obama administration, I think there will ultimately be a push for more student loan forgiveness too."

Khalfani-Cox has a high media profile. She has appeared on Oprah and is frequently interviewed on CNN, MSNBC, etc. about issues relating to debt. It's a good thing that she responded, and I want to publicly thank her for her remarks.

On another front, I am working with a loose coalition of people, some of whom are connected to the Rev. Jesse Jackson, about the student lending crisis. (The group I've mentioned several times, TICAS.org, is also a part of this group. That's a very important group. TICAS was founded by Robert Shireman who is now the Deputy Undersecretary of Education. So, yeah, they're a critical connection to the White House). More details about this collaborative work will follow, but for the time being I wanted to provide you with a quick update of activities and correspondence. (I still need to post about my email correspondence with Dr. Noam Chomksy, too).

Also, many of you are encountering some serious problems with CITI. As many borrowers are aware, CITI took over AES. I am in the process of responding to several people who have asked me for advice with this situation and some other lenders. I have specific instructions and will send that out to the people who requested help shortly. NOTE: If you feel that your lender may be up to illegal activities, I urge you to get in touch with me ASAP. There are ways we can combat these problems, and I can provide you with assistance. (Please email me here - ccrynjohannsen@gmail.com).

All right, that's enough for now. Phew. I am excited! This Thanksgiving will be much better than I thought. And, yes, I will be working tomorrow. The student lending crisis continues at a rapid pace, so there is no resting at this point.

On a final note, I got a great job, and it will allow me to devote more time to my advocacy work and writing. That means I'll have more time to be of assistance to more people who feel trapped by the student lending crisis.

I hope all of you have a wonderful Thanksgiving.

Hooray! Perhaps we're being heard!

Senin, 23 November 2009

If there's a war on the middle class, I'm enlisting to fight for it!

After writing Bait and Switch (a book you should all buy, as well as these other other texts), author Barbara Ehrenreich explains, " [it] inspired me to do something totally new . . . build an organization for unemployed, underemployed, and anxiously employed white collar workers. My research on the book showed me that college-educated workers are extremely vulnerable to downward mobility [my emphasis], and often end up in the kinds of low-wage jobs I had done for Nickel and Dimed. With some help from the Service Employees International Union, a group of people I met while on my book tour launched United Professionals in 2006, and we can be found at unitedprofessionals.org. We’re still small and struggling, but hoping to build a response to the 'war on the middle class' that is undermining so many lives." (I'm proud to say that I am a volunteer for UP and am a legislative researcher for their website!).

I certainly understand how quickly one can find herself on a sudden and unplanned track of "downward mobility," and I'm pretty sure that most of my readers understand exactly what Ehrenreich is talking about. Many of them are already there and are also part of the indentured educated class. That makes it even worse. (Edububble recently made a compelling argument about why it's so bad to be a part of this new class).

But I had no idea how vulnerable I was to become until quite recently. I don't know if that's a result of my naivete or some attempt to hold onto hope. One thing is certain, I now find much more comfort in Yelena's Ivy Leagued and Unemployed blog than I had before. Because at the end of the day, especially when you're living through Great Depression Deux, it doesn't matter if you went to Harvard, Brown, or some no-name school like Washburn. If there ain't jobs, there ain't jobs. So we're out of work, underemployed, and struggling to make through the month (for some, the next day).

I've always loved the theme of class, and researched and wrote about it as a Ph.D. student (I gobble anything up about the bourgeoisie!). However, the concept of class was something with which I became intimately familiar long before I had read and researched Marxist theories about the bourgeoisie or Walter Benjamin's notions about the arcades.

But I had no idea how vulnerable I was to become until quite recently. I don't know if that's a result of my naivete or some attempt to hold onto hope. One thing is certain, I now find much more comfort in Yelena's Ivy Leagued and Unemployed blog than I had before. Because at the end of the day, especially when you're living through Great Depression Deux, it doesn't matter if you went to Harvard, Brown, or some no-name school like Washburn. If there ain't jobs, there ain't jobs. So we're out of work, underemployed, and struggling to make through the month (for some, the next day).

I've always loved the theme of class, and researched and wrote about it as a Ph.D. student (I gobble anything up about the bourgeoisie!). However, the concept of class was something with which I became intimately familiar long before I had read and researched Marxist theories about the bourgeoisie or Walter Benjamin's notions about the arcades.

In fact, I grew up fearful of becoming impoverished as an adult. As long as I can remember, I thought it was inevitable. There are multifarious reasons for why I thought I'd end up in the poorhouse, but I won't delve into them here. Suffice to say one factor was a result of the fact that my father came from poverty. I was familiar with how hard the Great Depression was for my single grandmother (his mom), and grew up hearing stories about the Dust Bowl, empty cupboards, growling stomachs, and so forth (I even learned that chickens could taste like grasshoppers if they ate enough of those suckers during droughts!). Armed with a vivid imagination, I quickly worked out a kaleidoscope of rich, varied images that denoted the "utterly poor." It was terrifying stuff. These pictures were set against an ominous backdrop of impending financial doom.

My grandmother was a young woman in a world that looked like this picture - it was taken in Kansas in 1941!

Even though I grew up in a seemingly stable, beautiful, and big home, I was aware that my father always struggled to stay afloat. Nothing was ever big enough. We didn't have the newest BMW or Mercedes. The paint on our white colonial was constantly peeling. The carpets were filthy and needed to be replaced. Despite how hard my father worked, how many hours he spent away from home at his job, he struggled to maintain our upper-middle class lifestyle. (He was the first person in his family who obtained a college degree. More than that, he recieved an L.L.M. from the George Washington University). So long before the student lending crisis, I knew that a degree didn't guarantee security. Seeing a smart and well-educated man like him struggle to keep us in a nice home taught me a few lessons about class, as did his mother.

Just 6 weeks ago I revisited those childhood terrors, and thought once again about how easy it could be to end up homeless. Yep. That's how bad it has gotten for me. Many of you are aware that I recently had a major accident. I fell down a wooden flight of stairs and was unable to work for over a week. For complicated reasons that I'm not interested in discussing, I left my publishing job. In order to make ends meet, and with no luck landing another salaried position like the one I left behind, I decided to try and get back into the world of retail. It wasn't something I really wanted to do, but it was much better than my only other job prospect at the time - Outback Steakhouse. Again, the job of a server isn't beneath me, but it sure as hell wasn't' going to pay the hefty bills I have and were managing (kinda) to cover with my job in publishing.

Like many of you, I was scared out of my wits. When my current employer called me in for an interview, I was delighted. Sure, retail is tough work, but at least you stay clean, and you don't have to worry about spilling drinks on your customers. (I was a good server, so I never once spilled a drink on someone, but I bet my chances of pouring liquids on someone would have risen exponentially if I'd gone back to serving). I was offered the job and took it immediately.

I kid you not, that's what I looked a few hours ago, just before I came home. Phew, am I tired!

To make matters worse, I decided to throw myself down an entire flight of stairs. You aren't a good "salesgirl" when most of your back is severey bruised and you have lacerations on your arms, so - as I already said - I had to call out for an entire week. Since I am a new salesgal, I had to call on a regular basis to "touch base" with the HR office and assure them that I wanted to return. When I returned, limping and struggling to lift the lightest of objects, I learned that I had almost been let go. I may be injured and in pain, but I sure feel lucky as hell to have this job still. So, to hell with my back! I need to earn some sort of wage.

With this turn of events, I've been finding myself in some heavy conversations with my spouse. A whole lot of ever-so-serious talks have been happening for months now, and we're faced with making some serious decisions about our future here . . .

So, here's my question: what sort of serious big-stuff/life questions are you discussing with your loved ones and/or partner as a result of the economy and your student loan debt? (Please share below).

Minggu, 22 November 2009

Who says we aren't industrious? And what I would buy if I didn't have to pay the student loan sharks

I waged another "Craigslist Campaign" for FSLDM the other night, and posted about the group, wonderful Rob, and used Paul's awesome logo. Even though I posted under the category of "politics," most of my posts for the group have been flagged and removed, but I am pleased to see that a few still remain up (one in Boston, and another in Rhode Island). It's a simple message.

I received nasty emails as a result of these posts, but I think it's more than worth it. I've gotten pretty used to critics, and the nastier they are, the more I seem to get a kick out it. So, for instance, one woman (most likely she is quite lovely, given her delightful language) responded to this Craiglist ad by saying, "get off your lazy a#&$% and pay your loans back! That's what my husband and I did. We did expect $#&!@ handouts, so get to work!"

She is clearly a kind-hearted and gentle soul who only wanted to inspire me to get off my lazy arse and work - bless her heart. Her inspirational message also gave me a chuckle, because in the last year I have had 2 full-time jobs, and have been volunteering for the movement full-time. That means I work 7 days a week. Perhaps she is familiar with the Soviet calendar under Stalin (he extended the work week in order to industrialize as quickly as possible). In that case, I am definitely lazy, and I will take her advice to heart.

Regardless of how many jobs I manage to hold down (right now I have a full-time job, juggle freelance work on a regular basis as a content writer, and remain a steadfast cheerleader for FSLDM), I barely have enough money to cover my rent, groceries, and, of course, my student loans. Let's take a moment again to discuss the things we'd like to have if we were offered some sort of reprieve from our crushing loan debt. What would you, dear reader, buy if you didn't have to pay your student loan sharks each month? You most certainly aren't sitting around on your lazy $%#@, as this enlightened woman above seems to believe, are you? If you are, I insist that you get up this moment and get to work! Ha. In any event, I invite you to share again. The last time I asked people to share these things with me, they had the simplest wants - one woman wanted to buy curtains for her living room, while another person wanted extra money for gas so that she could visit her friends and family.

If I didn't have to feed my student loan lenders all of my hard earned money each month to bloat them further, I'd definitely be a contributing consumer and buy goods from all sorts of places. For starters, I am not fond of our mattress. I would buy a new Simmons beauty rest immediately. Moreover, it's been ages since I actually purchased clothing, so I know I'd grab a pair of new jeans from Nordstrom (the folks who work in T.B.D. know their products, and make people look amazing). It would be great to be able to buy my husband gifts on his birthday. Honestly, I can't recall the last time I was able to do that. He's a fantastic cook, so he was able to make me my favorite meal for my birthday (and thanks to so many of you again for your kind b-day wishes - that really made my day). I'm not trying to suggest that I'd be reckless with my expenditures. For one thing, it would be nice to be able to purchase my own groceries. I'm ashamed to admit that my in-laws (bless their hearts) buy my groceries. I am a grown woman, and yet I don't have enough money to purchase basic goods at the local grocery store! Luckily, my in-laws are kind and understanding people. They're so nice, they'd give the shirt of their back to a stranger. I'm serious. So, they're not the reason for my guilt.

I know that I am luckier than many of our followers, so I don't mean to complain. For instance, one woman wrote to me and explained that she's now the sole breadwinner for her family. Her mother has been gravely ill for months, and her father has had several serious surgical procedures. I think her story was one of the more difficult I've read lately, and I definitely shed an ample amount of tears. It is clear that she is certainly not lazy, and I found her concluding remarks quite inspirational. Indeed, I think she has more than enough on her plate to say, "I feel awfully sorry for myself." I think that would be more than justified. Instead, she just finished by saying, "I suppose we're an interesting [and] unusual case with the crumbling economy. I'm going to make an attempt to catalog at least some of it." She signed off, "thanks for listening :)"

It was an honor and a privilege to read her story, and I want to thank her for that. I found it more than amazing that she affixed a smiley face at the end of her message - talk about powerful. It would be interesting to hear what sort of purchases she'd like to make if she didn't have student loan debt and two ill parents.

In the very least, being a laborer again, just as my grandmother had been during the Great Depression, I think perhaps that I'm truly learning what Nietzsche meant when he discussed eternal recurrence . . .

I received nasty emails as a result of these posts, but I think it's more than worth it. I've gotten pretty used to critics, and the nastier they are, the more I seem to get a kick out it. So, for instance, one woman (most likely she is quite lovely, given her delightful language) responded to this Craiglist ad by saying, "get off your lazy a#&$% and pay your loans back! That's what my husband and I did. We did expect $#&!@ handouts, so get to work!"

She is clearly a kind-hearted and gentle soul who only wanted to inspire me to get off my lazy arse and work - bless her heart. Her inspirational message also gave me a chuckle, because in the last year I have had 2 full-time jobs, and have been volunteering for the movement full-time. That means I work 7 days a week. Perhaps she is familiar with the Soviet calendar under Stalin (he extended the work week in order to industrialize as quickly as possible). In that case, I am definitely lazy, and I will take her advice to heart.

Regardless of how many jobs I manage to hold down (right now I have a full-time job, juggle freelance work on a regular basis as a content writer, and remain a steadfast cheerleader for FSLDM), I barely have enough money to cover my rent, groceries, and, of course, my student loans. Let's take a moment again to discuss the things we'd like to have if we were offered some sort of reprieve from our crushing loan debt. What would you, dear reader, buy if you didn't have to pay your student loan sharks each month? You most certainly aren't sitting around on your lazy $%#@, as this enlightened woman above seems to believe, are you? If you are, I insist that you get up this moment and get to work! Ha. In any event, I invite you to share again. The last time I asked people to share these things with me, they had the simplest wants - one woman wanted to buy curtains for her living room, while another person wanted extra money for gas so that she could visit her friends and family.

If I didn't have to feed my student loan lenders all of my hard earned money each month to bloat them further, I'd definitely be a contributing consumer and buy goods from all sorts of places. For starters, I am not fond of our mattress. I would buy a new Simmons beauty rest immediately. Moreover, it's been ages since I actually purchased clothing, so I know I'd grab a pair of new jeans from Nordstrom (the folks who work in T.B.D. know their products, and make people look amazing). It would be great to be able to buy my husband gifts on his birthday. Honestly, I can't recall the last time I was able to do that. He's a fantastic cook, so he was able to make me my favorite meal for my birthday (and thanks to so many of you again for your kind b-day wishes - that really made my day). I'm not trying to suggest that I'd be reckless with my expenditures. For one thing, it would be nice to be able to purchase my own groceries. I'm ashamed to admit that my in-laws (bless their hearts) buy my groceries. I am a grown woman, and yet I don't have enough money to purchase basic goods at the local grocery store! Luckily, my in-laws are kind and understanding people. They're so nice, they'd give the shirt of their back to a stranger. I'm serious. So, they're not the reason for my guilt.

I know that I am luckier than many of our followers, so I don't mean to complain. For instance, one woman wrote to me and explained that she's now the sole breadwinner for her family. Her mother has been gravely ill for months, and her father has had several serious surgical procedures. I think her story was one of the more difficult I've read lately, and I definitely shed an ample amount of tears. It is clear that she is certainly not lazy, and I found her concluding remarks quite inspirational. Indeed, I think she has more than enough on her plate to say, "I feel awfully sorry for myself." I think that would be more than justified. Instead, she just finished by saying, "I suppose we're an interesting [and] unusual case with the crumbling economy. I'm going to make an attempt to catalog at least some of it." She signed off, "thanks for listening :)"

It was an honor and a privilege to read her story, and I want to thank her for that. I found it more than amazing that she affixed a smiley face at the end of her message - talk about powerful. It would be interesting to hear what sort of purchases she'd like to make if she didn't have student loan debt and two ill parents.

In the very least, being a laborer again, just as my grandmother had been during the Great Depression, I think perhaps that I'm truly learning what Nietzsche meant when he discussed eternal recurrence . . .

Please share below what you would purchase if you didn't have to send your hard-earned money to the student loan sharks.

Hey! Look everybody! My husband has just dropped by to say hello. I'm retrieving a pair of Prada shoes for a customer, just like my grandmother used to do in the 1930s. Aw. Cute.

Kamis, 19 November 2009

Even though you can't pay your bills, you don't have a job, and you're being harrassed by lenders, you should "remain flexible"

I love it. Five College presidents met in Troy to discuss concerns about graduates with excessive debt. These (cough, cough) geniuses are encouraging concerned graduates to be "flexible." One of them even suggested returning (yes! I'm not kidding) to graduate school. That apparently got the crowd laughing. Haha. I'm laughing too. Especially after reading emails from desperate people. It's hilarious. I'm glad these presidents had sagely things to add about the student lending crisis.

Reporters added that even Mr. Chuckles was all laughs during much of the round table discussion. Shortly thereafter he tore the face off of one of the Presidents and had to be put down.